Fascination About San Diego Home Insurance

Fascination About San Diego Home Insurance

Blog Article

Protect Your Home and Assets With Comprehensive Home Insurance Policy Coverage

Understanding Home Insurance Policy Insurance Coverage

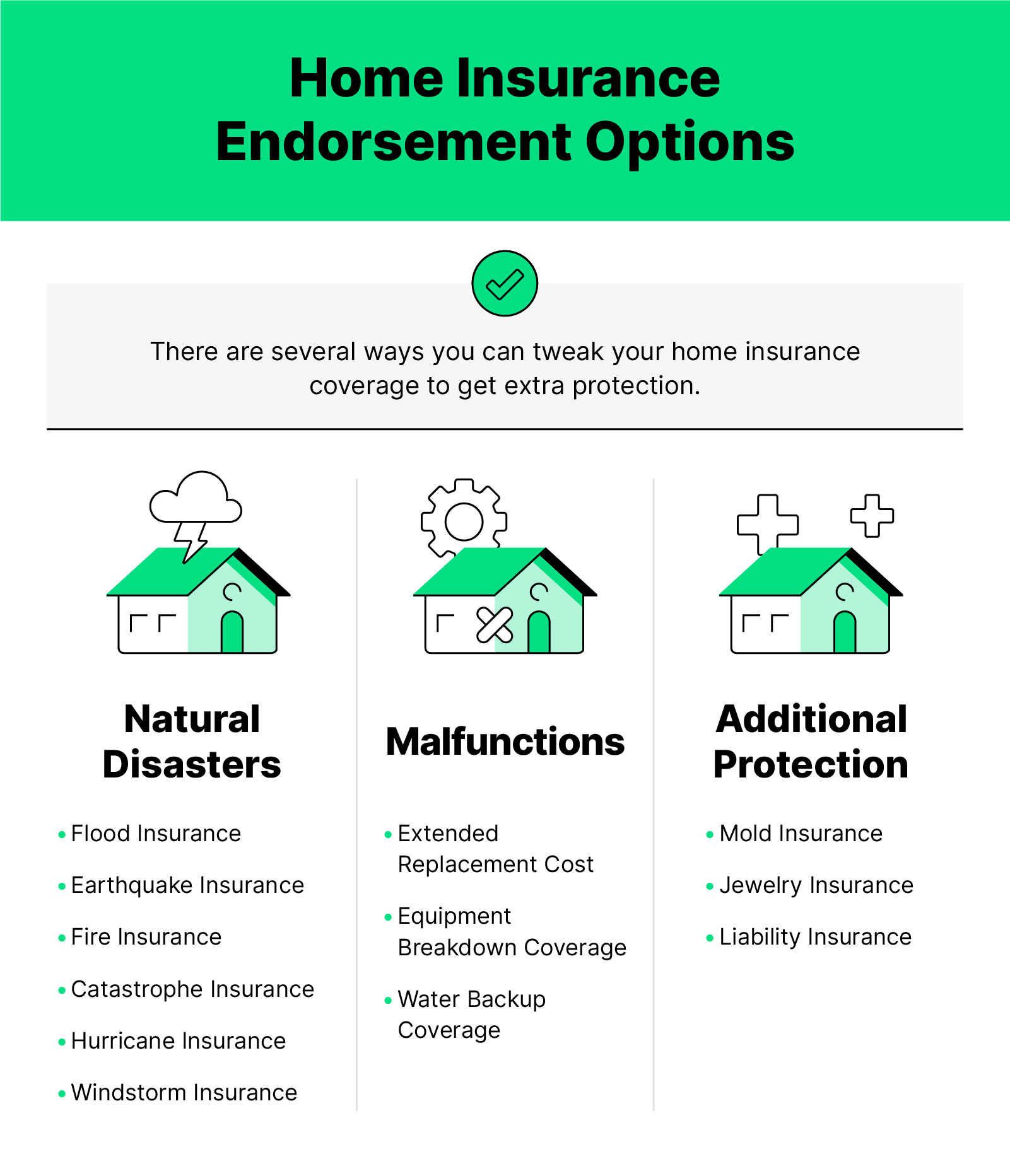

Comprehending Home Insurance coverage Protection is important for homeowners to protect their building and possessions in situation of unanticipated events. Home insurance policy usually covers damage to the physical structure of your house, individual valuables, liability protection, and added living expenses in case of a covered loss - San Diego Home Insurance. It is crucial for home owners to comprehend the specifics of their policy, including what is covered and left out, plan limits, deductibles, and any kind of extra recommendations or motorcyclists that may be needed based on their specific circumstances

One trick element of recognizing home insurance protection is understanding the distinction between real cash value (ACV) and replacement expense insurance coverage. ACV takes depreciation right into account when repaying for a protected loss, while replacement price coverage repays the full expense of changing or repairing the harmed property without considering devaluation. This difference can significantly affect the quantity of repayment gotten in the occasion of an insurance claim. Property owners must also recognize any type of insurance coverage limits, such as for high-value things like jewelry or artwork, and consider purchasing extra insurance coverage if essential. Being well-informed regarding home insurance policy protection ensures that property owners can adequately safeguard their possessions and investments.

Benefits of Comprehensive Policies

When checking out home insurance coverage, property owners can acquire a deeper gratitude for the protection and assurance that features thorough plans. Comprehensive home insurance coverage use a large range of benefits that exceed standard protection. One of the vital benefits is the substantial protection it provides for both the framework of the home and its components. In the event of all-natural calamities such as floodings, fires, or tornados, thorough policies can aid cover the prices of fixings or substitutes, ensuring that homeowners can recoup and reconstruct without bearing the complete financial burden.

Additionally, detailed plans frequently consist of protection for obligation, providing security in situation somebody is harmed on the building and holds the home owner liable. Comprehensive policies might likewise provide additional living expenditures insurance coverage, which can assist pay for short-term real estate and various other needed costs if the home ends up being uninhabitable due to a covered occasion.

Customizing Coverage to Your Needs

Customizing your home insurance protection to straighten with your certain requirements and conditions makes sure a efficient and personalized guarding method for your property and possessions. Customizing your protection permits you to attend to the distinct facets of your home and ownerships, providing a much more thorough shield against possible threats. By evaluating variables such as the value of your property, the components within it, and any kind of extra frameworks on your premises, you can establish the ideal degree of coverage required to safeguard your financial investments sufficiently. Moreover, tailoring your policy allows you to include specific endorsements or click resources riders to cover items that may not be consisted of in common plans, such as high-value precious jewelry, art collections, or home-based services. Understanding your private requirements and working carefully with your insurance policy service provider to tailor your protection makes sure that you are you could try this out properly safeguarded in the occasion of unpredicted circumstances. Inevitably, customizing your home insurance protection uses comfort understanding that your assets are protected according to your distinct situation (San Diego Home Insurance).

Guarding High-Value Assets

To appropriately safeguard high-value possessions within your home, it is important to evaluate their worth and take into consideration specialized coverage options that cater to their special worth and significance. High-value possessions such as art, jewelry, antiques, and collectibles may go beyond the insurance coverage limits of a conventional home insurance coverage. It is crucial to work with your insurance coverage copyright to ensure these items are appropriately safeguarded.

One means to secure high-value assets is by scheduling a separate policy or endorsement particularly for these products. This specialized coverage can supply higher coverage restrictions and may also consist of added securities such as protection for unintentional damage or mysterious loss.

In addition, prior to acquiring coverage for high-value assets, it is advisable to have these items skillfully assessed to develop their existing market price. This assessment paperwork can assist streamline the cases procedure in case of a loss and make sure that you get the suitable reimbursement to change or repair your valuable properties. By taking these aggressive steps, you can appreciate comfort understanding that your high-value assets are well-protected versus unanticipated scenarios.

Cases Process and Plan Administration

Final Thought

In verdict, it is vital to ensure your home and assets are properly safeguarded with detailed home insurance protection. By recognizing the coverage alternatives available, personalizing your policy to meet your specific needs, and protecting high-value properties, you can minimize threats and potential financial losses. Additionally, knowing with the claims process and efficiently managing your policy can assist you navigate any unexpected events that may develop (San Diego Home Insurance). It is critical to focus on the defense of your home and properties via comprehensive insurance policy protection.

One key aspect of recognizing home insurance policy protection is understanding the difference in between actual cash money value (ACV) and substitute expense protection. Property owners need to also be conscious of any insurance coverage restrictions, such as for high-value products like jewelry or art work, and take into consideration buying additional insurance coverage if needed.When exploring home insurance policy protection, property owners can gain a much deeper gratitude for the defense and tranquility of mind that comes with extensive plans. High-value assets such as great art, fashion my explanation jewelry, antiques, and antiques might surpass the coverage limitations of a conventional home insurance plan.In conclusion, it is essential to guarantee your home and assets are properly shielded with extensive home insurance policy coverage.

Report this page